How to Compare Mortgage Loans for the very best Prices and Terms

Simplify Your Home Getting Trip With a Trusted Home Mortgage Broker

The process of buying a home usually involves a myriad of complicated choices and economic dedications, making it important to approach it with a calculated mindset. Engaging a trusted home loan broker can enhance this trip, giving expert assistance and access to a variety of home mortgage alternatives customized to specific demands. This partnership not only reduces a few of the concerns connected with home loan applications however likewise opens chances for a lot more desirable terms. Yet, several possible customers continue to be unclear concerning just how to choose the ideal broker or comprehend their function completely. What variables should you take into consideration to make sure a successful collaboration?

Recognizing the Function of a Mortgage Broker

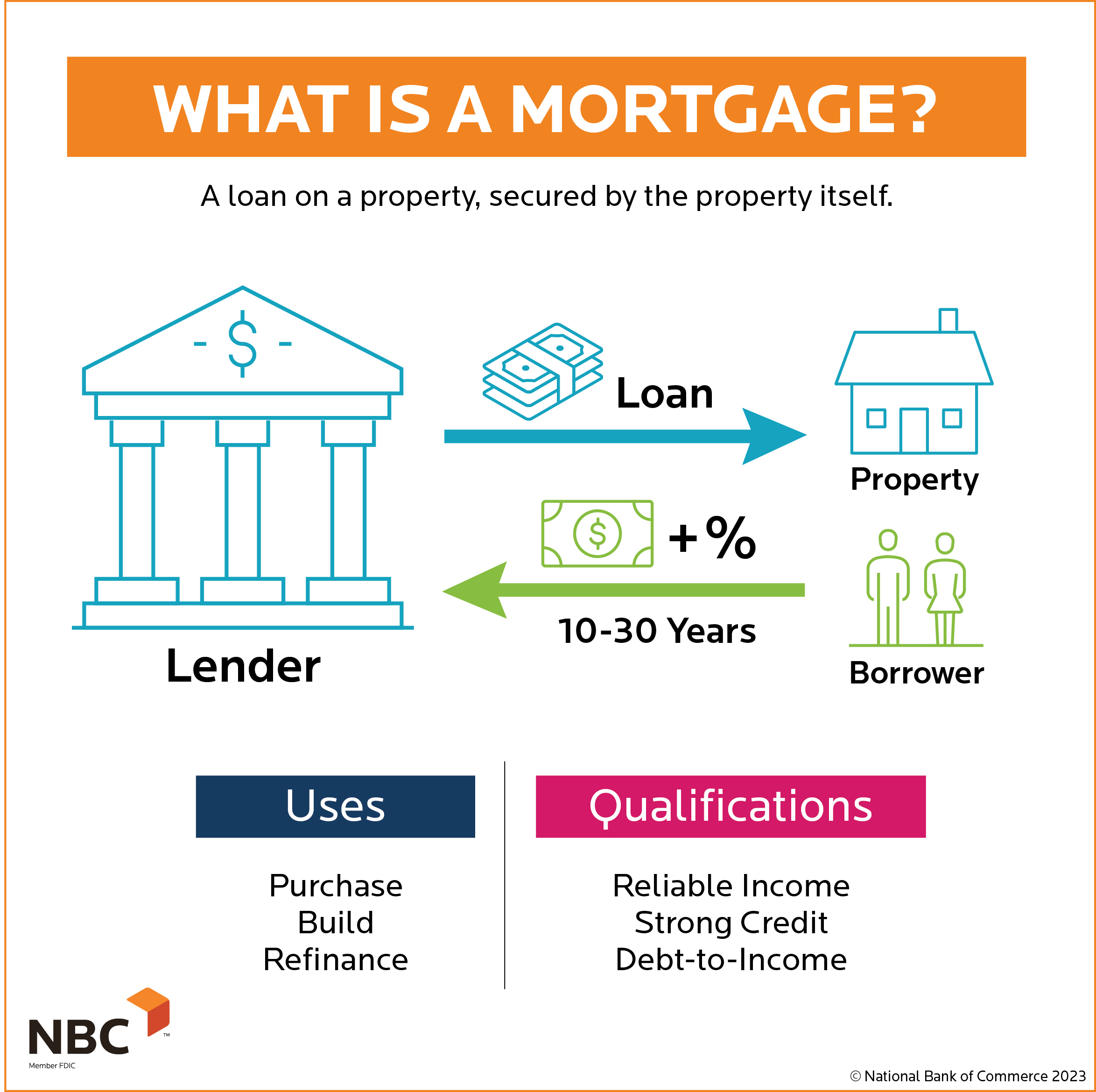

A home loan broker acts as an intermediary in between customers and lending institutions, assisting in the home financing process. Their key function is to analyze the monetary demands of the customer and attach them with suitable finance options from different lenders. This includes celebration necessary paperwork, such as revenue statements and credit rating, to examine the borrower's eligibility and monetary standing.

Along with finding suitable financing products, home loan brokers supply valuable market insights (Omaha Home Loans). They remain informed about present rates of interest, offering criteria, and emerging monetary products, ensuring that consumers obtain the most advantageous terms offered. Brokers likewise manage the detailed documentation related to mortgage applications, streamlining the process for their clients

Moreover, mortgage brokers bargain on part of the consumer, supporting for desirable terms and resolving any kind of worries that might occur during the underwriting process. Their proficiency can help browse possible challenges, such as credit report problems or distinct financing demands.

Eventually, home loan brokers play an essential role in boosting the effectiveness of the home financing trip, enabling customers to concentrate on locating their suitable home while guaranteeing that they protect the most effective feasible home loan options.

Advantages of Collaborating With a Broker

Collaborating with a home mortgage broker provides countless advantages that can substantially enhance the home getting experience. Among the main advantages is access to a broad selection of mortgage items. Brokers have partnerships with various loan providers, allowing them to present choices customized to individual financial circumstances, which can bring about beneficial terms and reduced rate of interest.

Furthermore, home loan brokers have comprehensive market expertise and experience. They can provide important understandings right into the home mortgage process, helping clients navigate complicated terms and documentation. This knowledge can conserve both time and initiative, permitting homebuyers to concentrate on finding their optimal home rather of obtaining bogged down in economic information.

An additional trick benefit is personalized service. A mortgage broker takes the time to understand a client's unique needs and goals, ensuring recommendations are aligned with their financial circumstances. Brokers deal with much of the communication with lending institutions, simplifying the procedure and minimizing stress and anxiety for the customer.

Finally, collaborating with a broker can boost settlement power - Omaha Home Loans. With their understanding of the market and lender assumptions, brokers can promote in support of customers to protect better bargains. In general, partnering with a mortgage broker streamlines the path to homeownership, making it a prudent selection for numerous customers

Exactly How to Choose the Right Broker

Picking the best mortgage broker is vital for a smooth home purchasing experience. Begin by examining their certifications; ensure the broker is qualified and has experience in the particular markets pertinent to your requirements. Seek brokers who have a tried and tested record and favorable reviews from previous clients.

Next, consider their interaction style. A great broker should be prepared and friendly to answer your concerns plainly. They should supply normal updates throughout the process, guaranteeing you continue to be informed and comfy with each step.

Examine the variety of products they use. A broker with accessibility to multiple loan providers can give you with various funding alternatives tailored to your financial circumstance. This adaptability can lead to much more positive terms and reduced interest rates.

The Home Loan Application Process

Just how does one browse the home mortgage application procedure properly? This details will certainly enhance the procedure and assist your home loan broker provide a complete application to lenders.

Next, job very closely with your mortgage broker to establish the kind of home loan that best fits your financial scenario. Your broker will certainly aid in analyzing your credit rating and economic health and wellness, which play vital functions in identifying your eligibility and car loan terms. They can also provide understanding into the find here various home mortgage items offered, ensuring you make educated decisions.

Once your application is sent, be gotten ready for the underwriting process. This phase includes a detailed exam of your monetary background and building evaluation. Your broker will maintain you informed and might request added papers to facilitate the authorization process.

Usual Mistaken Beliefs About Brokers

Lots of homebuyers nurture misunderstandings concerning the role and worth of mortgage brokers in the home getting process. A common idea is that home loan brokers are just salespeople pressing specific finance products. Actually, brokers act as intermediaries that help customers browse the complex loaning landscape. They function with multiple loan providers to locate helpful resources the most effective home loan alternatives tailored to every customer's financial situation.

An additional usual misconception is that using a broker incurs higher expenses. read this post here While brokers might bill costs, they usually have access to lower interest rates and better terms than those offered directly from loan providers. This can eventually conserve debtors cash over the life of the finance.

In addition, some customers assume that home mortgage brokers just provide to those with inadequate credit or uncommon economic scenarios. On the contrary, brokers offer a varied customers, from newbie property buyers to experienced financiers, offering important insights and tailored solution no matter the client's economic standing.

Verdict

Involving a trusted mortgage broker significantly boosts the home acquiring experience, using know-how and support throughout the process. By giving accessibility to diverse mortgage items and discussing beneficial terms, brokers alleviate the intricacies commonly related to securing a financing. Their detailed understanding of the market and personalized solution contribute to educated decision-making. Eventually, leveraging the solutions of a home loan broker can lead to an extra sufficient and effective home acquiring journey, customized to private economic scenarios.

Engaging a relied on home mortgage broker can improve this trip, providing professional advice and access to a range of home loan alternatives tailored to individual requirements. Mortgage Broker.A home loan broker offers as an intermediary in between loan providers and debtors, promoting the home financing process. A mortgage broker takes the time to comprehend a client's special demands and objectives, making certain recommendations are aligned with their financial situations.Next, work carefully with your home loan broker to figure out the kind of home loan that finest fits your monetary circumstance. Eventually, leveraging the services of a home loan broker can lead to a much more effective and satisfying home buying journey, tailored to individual financial circumstances